Demand for shipping containers is hyping up due to a rapid rush in shipping industry

Roughly 18 months into the Covid-19 pandemic, global shipping is still in crisis, with backlogs looming over the peak holiday shopping period. One look at the market and it's clear that a return to normal won't happen any time soon.

Before the coronavirus hit, companies could rent a humble 20-foot or 40-foot box with relative ease, allowing them to move goods at a low cost. Containers have a lifespan of about 15 years before they're recycled into low-cost storage or building solutions.

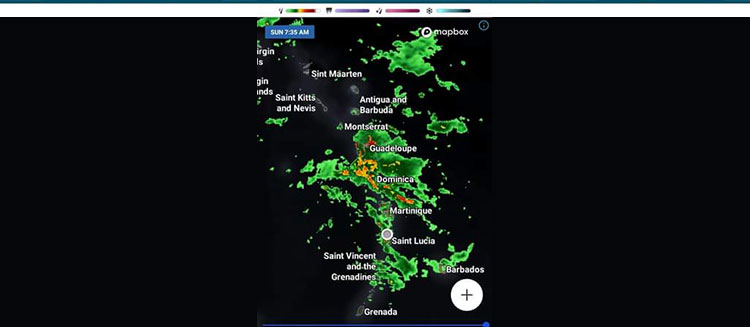

But empty boxes remain scattered across Europe and North America, while supply chain delays mean even more is needed to fulfill orders. Demand for goods, meanwhile, has soared — giving the network of ships, containers and trucks that deliver merchandise around the world little time to catch up.

The glut of empty containers — or "empties," in industry lingo — has persisted as coronavirus restrictions continue to snarl operations at ports and depots, and as shipping costs have continued to rise.

"If you look at container usage, we need significantly more boxes to move the same amount of cargo as we get them back, on average, 15% to 20% later than normal," Rolf Habben Jansen, the CEO of Hapag-Lloyd (HPGLY), one of the world's largest container shipping lines, said on a call with analysts last month.

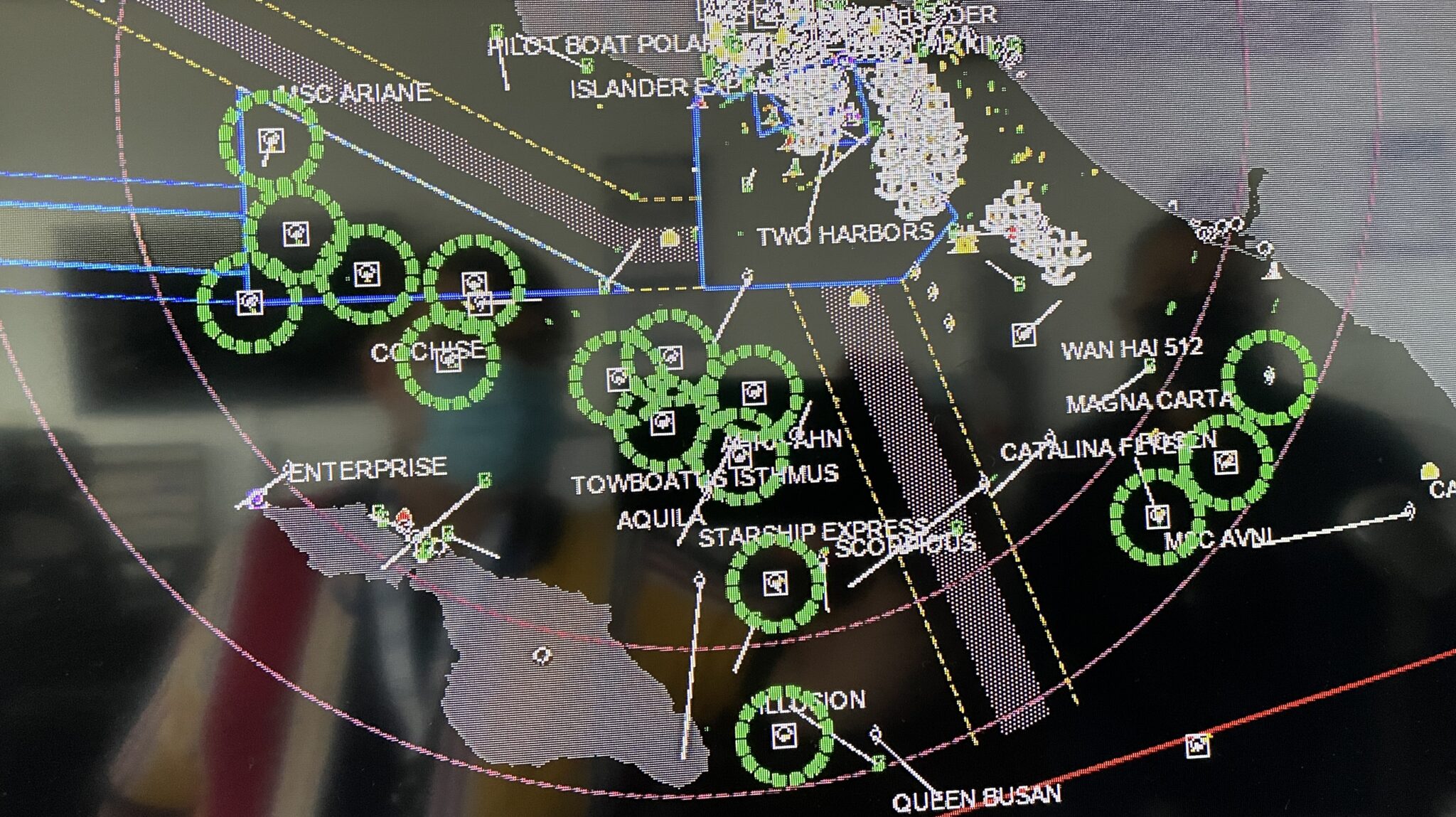

Konstantin Krebs, managing partner at Capstan Capital, an investment banking firm that works with investors in containers and container shipping, said backlogs at ports mean it can currently take ships up to four times as long to dock and unload goods.

"These ships are now sitting there for seven to eight days with all the containers on them," he said. "That takes a lot of containers out of the market."